The Reserve Bank of India has decided to maintain the repo rate at 6.5 percent, stating that it will take necessary measures in the future if required.

Despite having raised rates by 250 basis points since May of the previous year, the central bank has chosen to keep the key benchmark interest rate unchanged.

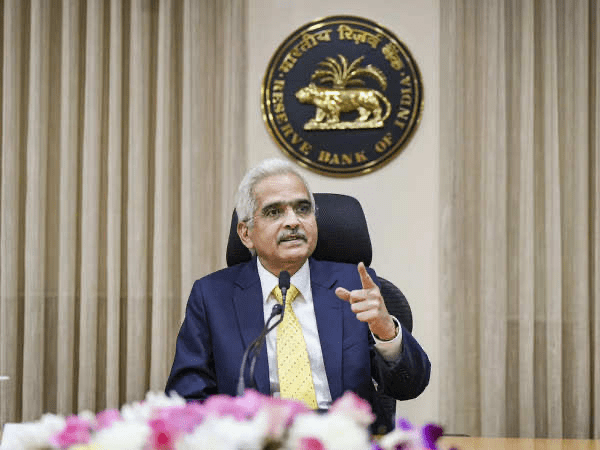

According to RBI Governor Shaktikanta Das, the central bank’s policy stance continues to prioritize the “withdrawal of accommodation,” suggesting that it may contemplate additional rate increases if needed.

However, Shaktikanta Das also stated that the decision to halt rate hikes was solely for the current meeting.

The RBI governor has forecasted a Real GDP growth of 6.5% for the year 2023-24, with the 1st quarter at 7.8%, Q2 at 6.2%, Q3 at 6.1%, and Q4 at 5.9%. Additionally, the governor noted that the economy remains sturdy, and headline inflation is expected to decrease in Financial Year (FY) 2023-24.

Governor Shaktikanta Das had previously warned that halting monetary policy action prematurely during a tightening cycle would result in costly policy mistakes.

The governor also expressed that it would be counterproductive to provide explicit forward guidance on the future of monetary policy in a world of high uncertainty.

The monetary policy committee remains watchful of the evolving outlook, impact of our actions over last year, said RBI Governor Shaktikanta Das.

“While we have kept policy rate unchanged, this decision was taken based on our assessment of the macroeconomic and financial conditions with reference to information available upto today.”

“Our job is not yet finished and war against inflation has to continue until durable decline in inflation closer to target is seen.”